How Much Can I Borrow Mortgage Joint Income

How much can we borrow with a 40000 salary. Cover for the things that matter most.

What Income Can I Declare To Support A Mortgage Moneyfacts Co Uk

You can include the total amount of both incomes when working out income multiples of your salaries to give an indication of how much you can borrow.

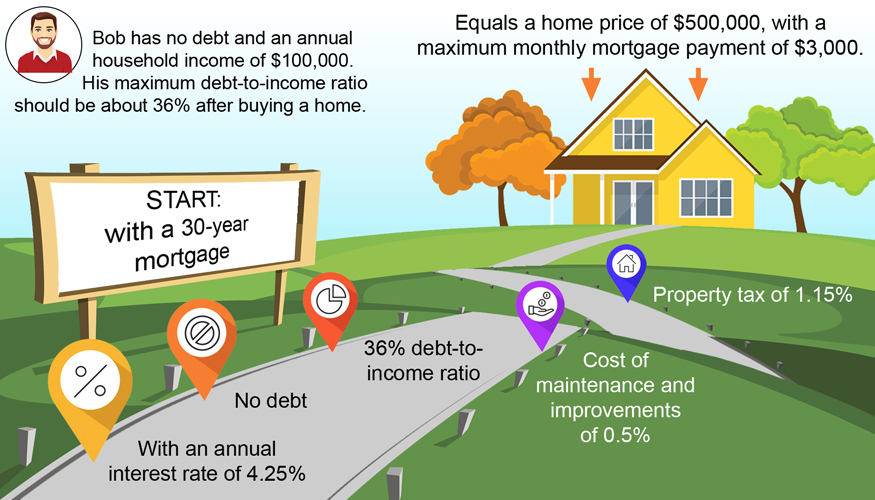

How much can i borrow mortgage joint income. Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances. We calculate this based on a simple income multiple but in reality its much more complex. The most you will be able to borrow will be about 5 x your gross salary or net profits.

But if you bought with another person whose annual income was also 30000 this could double the amount you could borrow to 270000. This specific lender uses an income multiple of say 4x salary for joint applicants therefore would. How much you can borrow depends on your means and your income based on rules laid out by the Central Bank of Ireland.

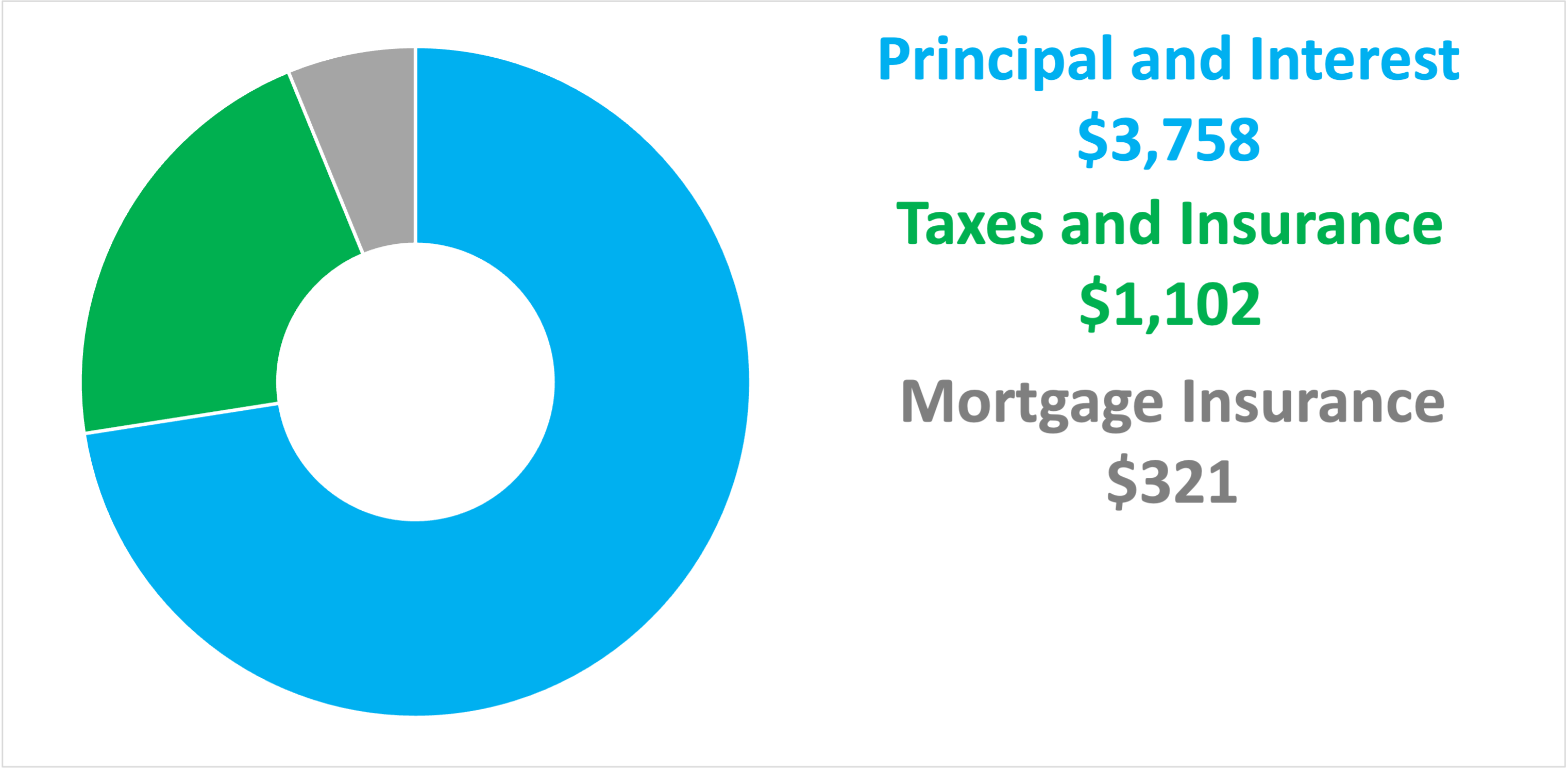

How much can we borrow for a joint mortgage. You could borrow up to. For loans secured with less than 20 down PMI is estimated at 05 of your loan balance each year.

It is important to understand how much you can. Could borrow on a single or joint basis. Mortgage lenders used to calculate how much they would lend by a simple rule-of-thumb multiplication of an applicants income.

Expenses Any outgoings you have like credit cards insurance bills or loan payments. How much can I borrow. Tue 13 Jan 2009 1910 EST.

Find out how much you can borrow using our mortgage borrowing calculator simply by answering a few questions. Use the slider to see how much you. Change the deposit you can provide or the amount you want to borrow to see how that affects your result.

Our mortgage borrowing calculator will provide you with an approximation of how much youre likely to be able to borrow but please remember this amount will vary from lender to lender and will also depend on things like your monthly credit commitments. You can calculate how much you can borrow based on a single or joint mortgage application. 4 or 45 times salary was the limit.

Your rough mortgage borrowing estimate. Find out how much you can afford to borrow with NerdWallets mortgage calculator. Income Your salary plus any other income from pensions or child maintenance support.

Your dedicated mortgage adviser will be able to confirm the exact amount you can borrow with several different High Street lenders. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other debts such as car or student loan payments should be no more than 43 of your pre-tax income. As two incomes are typically larger than one then a joint income mortgage application should result in a higher maximum amount you can borrow for a mortgage.

Traditionally most lenders have used a simple joint income mortgage calculator to establish how much a couple can borrow for a mortgage based on a multiple of their combined income. While some lenders will allow up to four people to take out a joint mortgage theyll generally only consider the two highest incomes when deciding how much to lend. To work out how much you can borrow the main factors mortgage providers tend to look at are.

This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. Monthly PMI is calculated by multiplying your starting loan balance by this percent and dividing. You need to go directly to a lender to find the exact amount they can lend you.

Loan to value of. So a first-time borrower earning 30000 a year who could put down a 5 deposit could go looking for properties up to a maximum price ceiling of 142000. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage.

Last modified on Tue 13 Jan 2009 1049 EST. For example a married couple with a combined household income of 60000 approach a lender for a mortgage. Q Having sold our home my husband and I.

This can be your joint income in the case of joint mortgage applications The annual payment of any loans or credit agreements should be deducted from your income before applying this multiple. And remember even though there might be a limit to the amount you can borrow you can save as much deposit as you like to make up the balance. The calculation shows how much lenders could let you borrow based on your income.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Where there are more than two applicants most mortgage lenders will use the two highest incomes for the purpose of establishing the maximum amount you can borrow. Sometimes taking out a joint mortgage can increase the amount you can borrow especially if you both have well-paid jobs.

Each lender has their own way of checking how much you can borrow and they look at your credit history and spending habits to help decide. How much can I borrow. The amount shown is an estimate based on a multiple of your sole or joint income.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Money Do You Have To Make To Afford A 1 Million Home Lowestrates Ca

Eight Amazing No Frills Home Loans Jason Bryce Freelance Journalist Loan Home Loans Mortgage Loans

Obtaining Loan For College These Days Appears All But Inescapable For Everybody But The Wealth Student Loan Repayment Student Loan Repayment Plan Student Loans

How Much House Can I Afford Fidelity

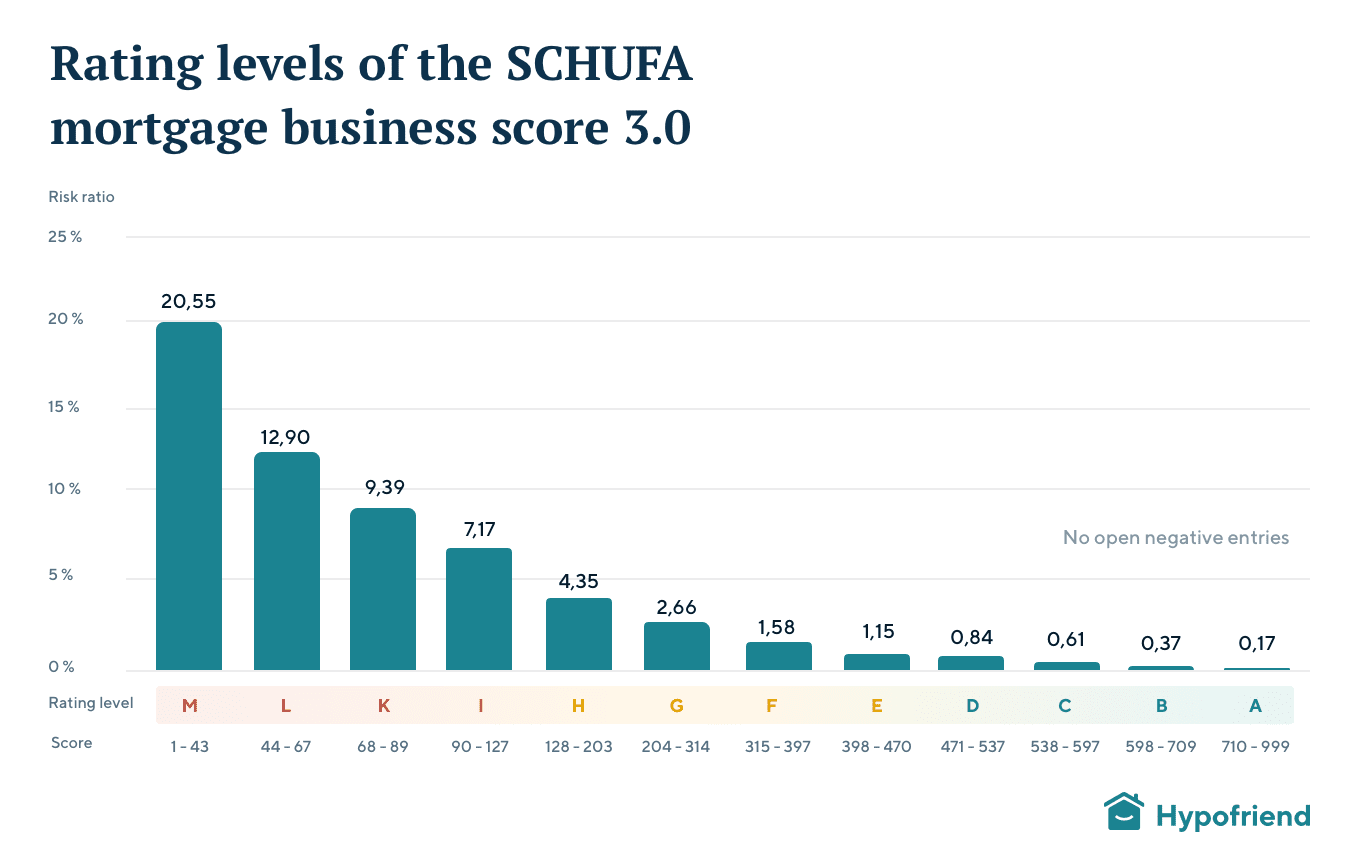

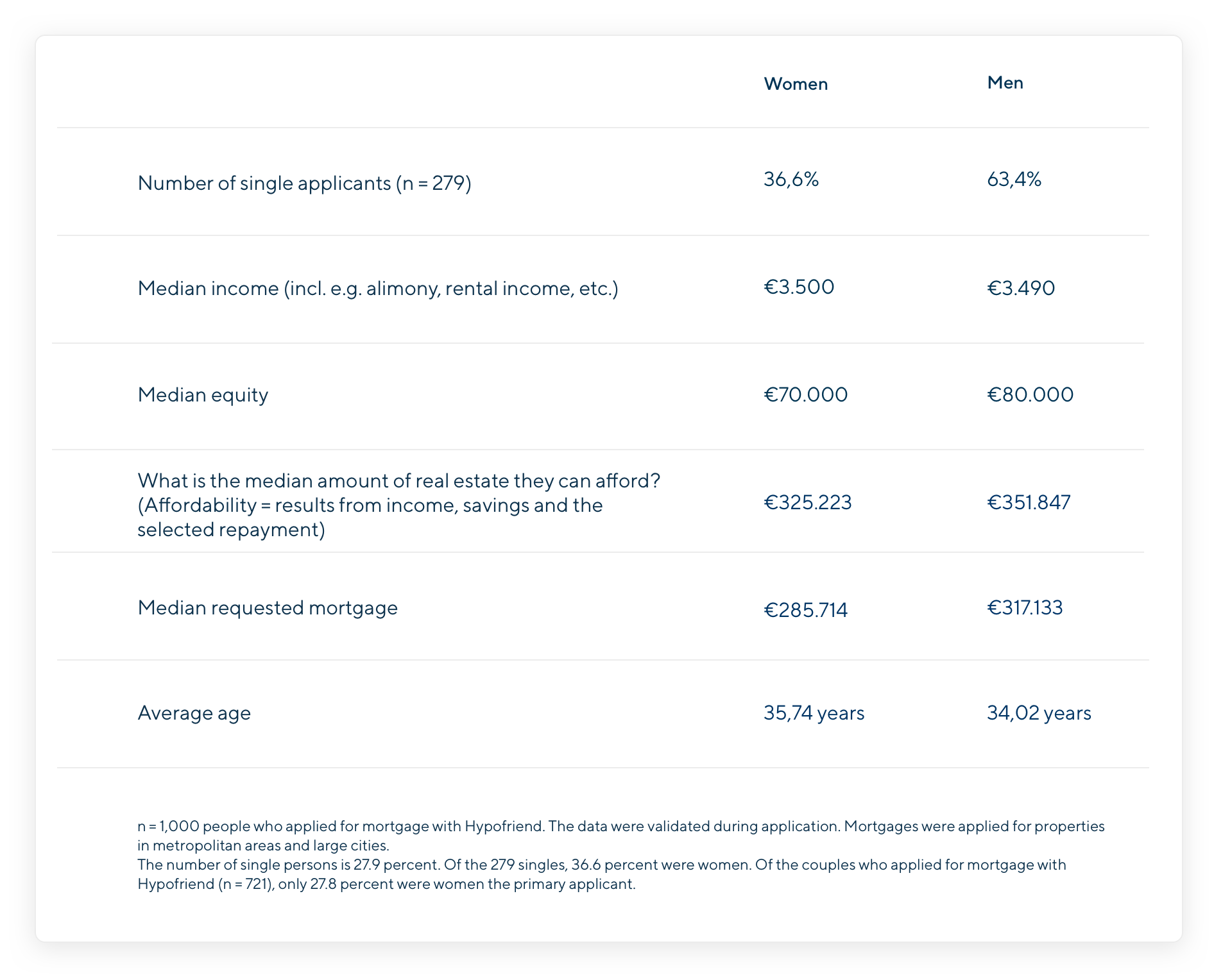

Mortgages In Germany Explained Hypofriend

Some Factors That Will Affect Your Home Loan Eligibility Home Loans Loan Savings Bank

Homebuying Vs Renting A Cost Comparison Rent 30 Year Mortgage Being A Landlord

Pin On Our Home Loans Houston Online

Avail Income Tax Benefits That Come With A Joint Home Loan Home Loans Loan Mortgage Estimator

Benefits Of Owning A Home Advantages Of Owning A Home Re Max Nj Home Ownership Buying A New Home Remax

700k Mortgage Mortgage On 700k Bundle

Joint Mortgages How Do They Work L C Mortgages

Banktivity 7 For Mac Is Fully Featured Personal Finance Software Personal Finance Finance Smart Money

Mortgages In Germany Explained Hypofriend

How Many Times My Salary Can I Borrow For A Mortgage Yescando

Mortgage 101 Benefits Of Being A Homeowner During Tax Season Diy Taxes Tax Season Tax Help

Don T Let These Home Buying Myths Fool You Home Buying Real Estate Fun The Fool

Posting Komentar untuk "How Much Can I Borrow Mortgage Joint Income"